Yes Bank Stock Analysis

The stock of Yes Bank Ltd. is currently faring

better than the previous year at a price of INR 23 but it’s is nothing compared

to the performance of the stock when the price of stock hovered near about INR 300

levels during its meteoric rise in 2018-19 after which it was hit by various

scandals perpetrated by its founder Rana Kapoor. In an RBI report it was

alleged that Rana Kapoor along with other management staff was involved in

siphoning of funds to certain companies and hiding actual loses from the eyes

of the public which amounted to around 3,277 crores along with lending loans to

a number of financially stressed companies like Jet airways, CCD, Essar and so

on. s

But recently the bank’s metrics have been

improving with Liquidity to coverage ratio falling from 118 in previous quarter

to 116 in the present quarter of 2024 mainly driven by growing deposits and

lower credit costs. The bank has been introducing new concepts to induce

organic growth, the following two are the main concepts

·

Spectrum

banking: It is basically online banking services offered with extra layers of

encryptions and security

·

Cluster

banking: Offering lending services to a well-defined cluster of MSE in certain

regions. The bank started such initiative in the districts of Ujjain and Nashik

by opening more branches, more ATMs and business correspondent banking centers.

New initiatives such as Yes private program and

Yes First for UHNI customers will help the bank in gaining larger share of

these individuals by offering curated services catering to requirements of

their business or wealth management, under the “Yes Private Programme” 1,500

customers have been enrolled putting money worth around 3,400 crore rupees.

All of the above schemes increased the bank’s

current quarter 2024 Net Profit has to rupees 231 crore as compared to rupees

51 crore in the same quarter’s earnings in 2023. Recently the Carlyle Group

sold 39 crore shares of Yes bank worth rupees 1,056 crore which were then

bought by Morgan Stanley Asia. Currently

the bank is looking for a new promoter to sell around 51% stake in the company

for a valuation of around which is supposed to increase the share price.

The bank is

implementing certain strategic business objectives which are described in boxes

below:

The bank has been active in mitigating the

climate risks by funding environment friendly business. It doubled the EV based

assets to INR 120.41 crores and offered financing solutions worth INR 1,482

crores to renewable energy plants in India. Yes, Bank is the only Indian bank

to be a part of UNEP’s committee responsible for managing the “Principles for

Responsible Banking and Collective Commitment to Climate Action” and recently

the bank was awarded an A-rating by Carbon Disclosure Project for its 2022 Climate

Change Disclosures.

The bank has been an active player in promoting

financial inclusion by establishing divisions like Inclusive and Social Banking

along with Microfinance banking. Through its network of AePS and micro- ATMs

the bank plays a vital role in sending remittances to rustic regions of India.

YES LEAP, the bank’s group lending program offers financial services to SHGs,

JLGs, and microfinance institutions. The rural portfolio is spread over 225

districts with total advances of around INR 4,836 crores and conducting around

1,798 financial literacy camps in rural areas.

ANALYSIS

Moving Average Convergence and Divergence

Oscillator:

MACD is a trend following momentum which tries to

explain the relationship between 12 days and 26 days Exponential Moving Average

(EMAs) to measure the trends in price movements to identify the market entry

points.

When the distance between MACD and Signal lines increases there is a strong momentum in the stock. The MACD crossover can give an early sign of a reversal. Since we can see that the MACD line is same as the signal line which indicates that there is neither bullish nor bearish perspective among the stock brokers. But we can see that the MACD line is always near the zero line after 2019 which means there is a chance that the price may bounce back in future which is known as Zero-line Pullback.

COMPARISON

The above graph shows that the bank has to

cover a lot of ground in terms of its stock price when compared to IndusInd

Bank’s stock price which is one of the top 10 banks in India with 2,606

branches offering services to around 34 million customers. But as per the MACD

indicator there is a chance that the price of yes bank stock may increase in

future whose potential can be very much high offering larger gains.

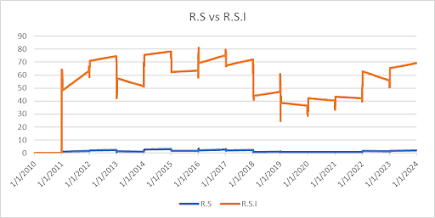

RSI is a measure of stock momentum by

describing the speed and size of price changes. This information can be used to

determine whether the stocks are overbought or oversold, according to which

investors can decide to exit the stock. So, I have calculated RSI for Yes bank

and IndusInd bank on the basis of 14 days to compare whether we should exit

from Yes Bank or not. RSI Index is also calculated to determine whether a stock

is supposed to enter a trend reversal or corrective pullback in future. An RSI

index above 70 level may indicate over enthusiasm regarding the stock among

investors which pulls the price of the stock to meteoric levels.

The following is the formulae for RSI Index:

Since the RSI of yes bank is near about 70 level indicating that the stock might turn out to be overbought soon, investors need to be cautious to determine when to exit the stock if it cross level 70 and then falls below this level. Also, the RS line shows that there is very few possibilities for the stock to rise in the future but given the stable nature of yes bank’s business along with future diversification possibilities into new areas the stock can be of very high potential.

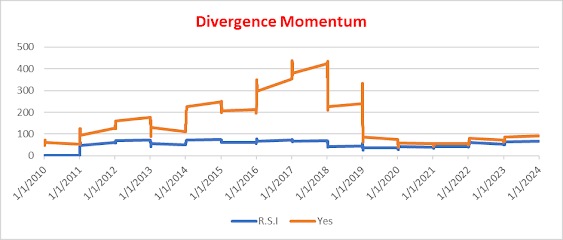

From the above graph we can see that there was high divergence between RSI and price of stock for yes bank during 2019-20 when it was being probed by authorities for being engaged in illegal activiities but at present the divergence has been less impying that higher highs in yes bank stock price and lower highs in RSI, which means that there is a possiblity of uptrend in stock price.

But when we see the same graph for IndusInd bank we can see no divergence indicating more stability in the price of the stock. Here the RSI is having higher highs and price having lower highs indicating higher chances of increase in price of the stock as compared to the price of Yes bank stock.

VALUE AT

RISK

VAR (Value At Risk) is a statistical measure that

gives us the maximum amount of loss that can occur for a given period of

holding for a certain level of confidence level. I have calculated VAR using

the historical method which uses returns belonging to the lowest quintile of

the price distribution defined by the confidence interval.

From the comaprison below we can conclude the

following :

A 5% VAR of 18.86% for Yes Bank Ltd. Means that there

is a 95% confidence that the stock will not have a loss higher than 18.86% on a given day where as the VAR for Induslnd

bank at 5% level is 14.47% indicating that loss is limited as comapred to the

Yes bank stock price. Since VAR doesn’t give any information about a potential

loss higher than VAR itself it can be used to predict future losses.

But given the comparison between Yes bank and IndusInd bank stocks we can see that as per VAR Yes bank always have a higher percentage of loss for all the confidence interval.

|

Confidence Levels |

90% |

95% |

99% |

|

VAR |

.188269 |

.221144 |

.366134 |

|

Confidence Levels |

90% |

95% |

99% |

|

VAR |

.144735 |

.205132 |

.319912 |

TREND ANALYSIS

Trend analysis is a kind of analytical method used to

forecast some kind of pattern in a set of data. Through this market trend

analysis I have ploted four graphs below to predict the movement of stock

prices of four Indian banks.

A basic trend model tells us the predicted value for

the dependent variable over a specified time period. In the present case I have

used a liner-log model given as follows:

Yt = a +

log(t) + et

Yt : is the predicted value for the EPS of

the stock

Log(t) : log of the time period

et : is the error term

I have collected data on earnings per share of the

above mentioned banks for 18 years on a quaterly basis and decided to run a

trend analysis on this historical data. Since EPS tell us about the future

profitablity of a firm as it is calculated by dividing the net income by total

number of comman shares. So an uptrend in EPS would surely signal that the

enterprise is going to be profitable in the future as a higher EPS means that

the company can provide a higher payout to the shareholders.

From the following comparison we can conclude that:

·

For

Yes bank we can see that the EPS trend line is expected to fall in the future

even though at current it is hovering at rational levels.

·

IndusInd

and Axis Bank EPS trend lines are expected to rise meaning these two stocks can

be profitable in future as comapred to owing shares of Yes Bank Ltd.

The above figure tells that over a relative time period the EPS of Axis bank would increase by 63.19% with a goodness of fit given by 16.16% whereas for Yes Bank for one unit increase in the relative time period Yes Bank EPS is predicted to fall by 41.73% but the goodness of fit is very small around 2.7%. Because a small goodness of fit means that the model is a poor predictor of the data and is bound to give a spurious results. But still we can focus on the trend of EPS in the Yes Bank shares which shows a downward trend, hence investors need to be cautious whether to decide to buy shares or not.

The model for IndusInd bank predict a better result with a one unit increase in time period the EPS of the stock increases by 183.73% along with an upward trend.

Yes bank is

closely related to the performance for Canara bank with a similar downtrend so

it won’t be advisable to make a portfolio consisting of only these two bank

stocks.

I have used

the famous Benjamin Graham formula to predict the expected growth value of the

stocks over 2 years, which by following:

V* = EPS x (8.5 + 2g)

EPS: means

the earnings per share of the company

g: means

the expected growth rate in price of the firm

8.5 is the

usual price earnings ratio for a no growth mid-cap firm usually referred to as

the Graham number used by a lot of analysts and made popular in his famous book

“The Intelligent Investor”

So when we

applied the above formula to get a expected growth rate for 2 years we found

that yes bank stock is expected to fall by 12.52% whereas the IndusInd bank is

expected to rise by 140.23 % but as said by Benjamin Graham himself there is no

perfect science to predict the valuation of a stock, the fellow investor can

decide to buy Yes Bank stock at cheap and decide to hold it for long term.

R1:

current stock price

R0:

post stock price

g: average

growth rate of the stock price

Since the basic principle of forecasting

requires that forecast should be less variable than the variable forecasted

because if the forecasting is highly volatile, we can’t see the existence of a

trend which means that the stock prices aren’t reflecting any information

related to future prospects, dividend payouts, cashflow positions, etc.

We can conclude from the following diagrams

that the yes bank stock is expected to show an uptrend in the future whereas

the stock of IndusInd bank is showing a flat forecasting line meaning not much

potential gain.

Comments

Post a Comment